How to set up a bank account in gibraltar.

Benefits of opening a bank account in gibraltar.

Funds on the accounts are secured within deposit protection scheme of 100 000 euro.

Minimum amount to be held in the account is 10.

Luckily there is no need to search for long in order to find good alternatives.

Non residents opening a bank account in lithuania will find the process complex.

The documents needed and the process to expect.

Bank account opening requirements are subject to change at the discretion of the bank.

In order to open a bank account applicants must be eligible and fulfil the criteria associated with the account and bank of choice.

Banking facilities are confidential as banks policy.

Deposits made by cheque need to be made out to gibraltar savings bank.

Gibraltar company formation as an alternative.

Interest on savings are exempt from taxation.

Copy after the id passport or driver s license.

What are the requirements for opening a bank account in gibraltar.

Many banks in the rock offer the possibility of opening a bank account through an online procedure however it is advisable to go in person when opening a current account the following documents must be provided.

There might be restrictions on ubo nationalities business activities and or jurisdictions.

Details of transactions carried out from a corporate offshore bank account will not be disclosed to any.

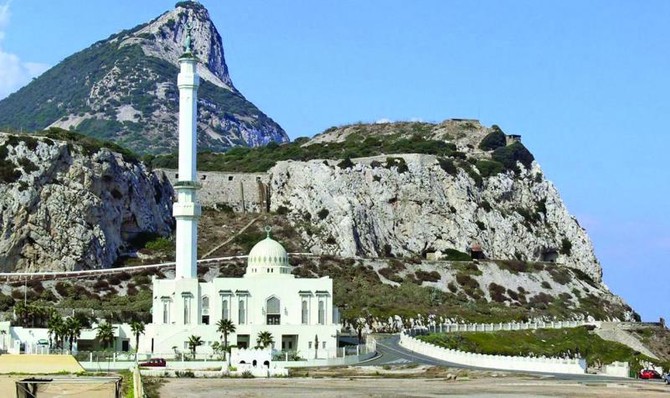

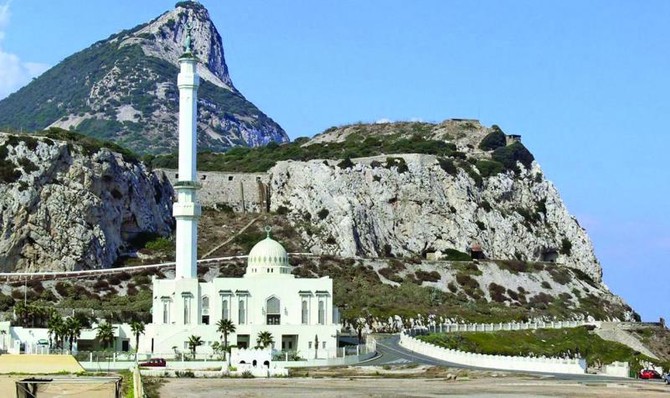

Find out how to go about opening a bank account in gibraltar.

Bank account opening is not guaranteed and is subject to the bank policies and compliance department.

Gibraltar s banks are fully licensed and regulated.

Gibraltar bank account holders are protected by the eu deposit protection scheme up to 100 000 euro for accounts held in gibraltar.

Thereafter an account opening form must be completed per account opened.

Gibraltar s special status in the eu is an advantage for gibraltar account holders.

The central bank controlling the gip with the responsibility of minting coins and printing notes is the government of gibraltar.

A gibraltar non resident company is likely the most cost effective offshore tool available across the european continent.

One of them is gibraltar.

Recent new banking policies require non.

There might be additional fees charged by the bank itself.

Key features benefits of opening a bank account in gibraltar.

An application form must be completed and submitted along with other required documents.

Payment of benefit is financed by the weekly contributions made by employers and insured persons to the statutory benefits fund.

A client information form is required per new applicant.

As a british overseas territory gibraltar has a governor appointed by the monarch of the united kingdom who works as a representative of her majesty s government.